Debt Purchasing Property in Upstate New York City: Opportunities and Considerations

Debt investing in property has actually gained grip as a strategic, usually much less unstable alternative in real estate financial investment. For financiers looking at Upstate New york city, financial obligation investing provides a distinct way to enter the real estate market without the operational duties connected with straight residential property possession. This guide checks out financial debt investing in Upstate New york city, outlining key approaches, benefits, and factors to consider for optimizing returns in this area's increasing property market.

What is Financial Debt Purchasing Realty?

In real estate financial obligation investing, capitalists supply lendings to property designers or property owners as opposed to buying the residential properties themselves. This investment model allows investors to earn interest revenue, with the home as collateral in case of default. Financial debt investing can be structured through numerous forms, such as:

Straight Fundings - Investors funding funds directly to building developers or property managers.

Realty Investment Company (REITs) - Some REITs concentrate only on financial obligation financial investments, merging capital to buy mortgages and debt-related items.

Real Estate Crowdfunding - Online systems that allow capitalists to contribute smaller quantities toward a bigger lending, supplying access to a diversified property financial debt profile.

Why Select Upstate New York City for Financial Debt Real Estate Spending?

Upstate New york city presents a number of benefits for real estate debt capitalists, driven by its mix of metropolitan revitalization and rural need. Secret factors that make this region attractive for financial debt financiers consist of:

Growing Property Market

Cities like Buffalo, Rochester, Syracuse, and Saratoga Springs have seen development in real estate demand. The raised interest in both residential and industrial property, frequently driven by a change toward rural and small-city living, develops opportunities for consistent financial debt investments.

Varied Residential Or Commercial Property Types

Upstate New york city uses a selection of real estate kinds, from household homes to multi-family homes and industrial structures. The diversity enables financiers to choose buildings with differing threat degrees, straightening with various financial investment goals and timelines.

Steady Need with Less Volatility

Contrasted to New York City City, the Upstate market often tends to be a lot more steady and much less affected by rapid price variations. This security makes financial debt investments in Upstate New York a solid alternative for financiers seeking lower-risk returns.

Cost Effective Entrance Points

Property worths in Upstate New York are generally less than those in the city, enabling financiers to participate in the property debt market with reasonably smaller capital outlays, making it ideal for both novice and experienced financiers.

Benefits of Financial Debt Purchasing Upstate New York City Real Estate

Easy Revenue Generation

Financial obligation investing in property can be an perfect means to generate constant easy income without the hands-on administration called for in direct home possession. Investors receive routine passion payments, providing foreseeable revenue streams.

Collateralized Safety and security

In a financial obligation financial investment, the property functions as security. In case of a default, financial debt capitalists might have the possibility to confiscate on the building, adding an additional layer of security to their investments.

Much Shorter Financial Investment Horizons

Contrasted to equity financial investments in realty, debt investments often have much shorter durations, typically varying from one to 5 years. This versatility appeals to investors seeking returns in a much shorter period while retaining an option to reinvest or leave.

Possibly Lower Threat

Financial obligation investors usually sit higher on the resources stack than equity investors, suggesting they are paid back initially if the debtor defaults. This reduced threat profile, incorporated with routine revenue, makes financial obligation investing eye-catching to risk-averse financiers.

Trick Strategies for Successful Financial Obligation Buying Upstate New York

Review Home Place and Market Trends

Assessing building areas within Upstate New york city's varied landscape is crucial. Financial debt investments in high-demand areas, such as residential neighborhoods close to major employers or expanding commercial centers, are generally safer wagers with a reduced threat of debtor default.

Partner with Credible Debtors

Vetting debtors is vital in debt investing. Search for borrowers with a solid record in realty advancement or residential or commercial property monitoring in Upstate New York. Experienced consumers with tried and tested tasks lower default danger and contribute to steady returns.

Choose a Mix of Residential and Commercial Debt

To expand risk, think about debt investments in both household and business properties. The household market in Upstate New York is strengthened by stable real estate need, while commercial buildings in revitalized city areas offer chances for higher returns.

Utilize Realty Financial Debt Operatings Systems

Platforms like PeerStreet and Fundrise permit investors to take part in property financial obligation with smaller sized contributions. Some platforms focus especially on Upstate New York buildings, allowing a local investment technique. These platforms simplify the procedure of identifying financial https://sites.google.com/view/real-estate-develop-investment/ debt opportunities with pre-vetted debtors, due persistance, and documents.

Potential Challenges in the red Investing in Upstate New York City

Danger of Default

Similar to any finance, debt investing brings a danger of consumer default. Very carefully examining the consumer's creditworthiness, the residential or commercial property's place, and the lending terms can assist minimize this risk.

Liquidity Constraints

Realty financial obligation financial investments typically lock up capital for a fixed period. Unlike stocks or bonds, financial obligation financial investments can not constantly be promptly sold off. Investors ought to be gotten ready for these funds to be unavailable up until the loan term ends or a second market sale comes to be viable.

Interest Rate Sensitivity

Real estate financial debt returns are influenced by dominating interest rates. Climbing rates of interest can influence debtors' capability to pay off, particularly if they rely on variable price lendings. Evaluating how prospective price modifications might impact a specific financial investment is crucial.

Due Persistance Demands

Realty debt investing requires thorough due persistance to recognize feasible chances. Investors need to check out residential property values, rental demand, and consumer qualifications to reduce risk and make certain that the financial investment lines up with individual monetary goals.

Just How to Begin with Debt Property Purchasing Upstate New York

Study Market Trends

Begin by checking out real estate fads in Upstate New York's famous cities and towns, consisting of Buffalo, Rochester, and Albany. Comprehending neighborhood market patterns helps in determining potential development areas and emerging financial investment chances.

Connect with Regional Property Investment Teams

Real estate financial investment groups and clubs in Upstate New york city can be valuable resources for networking, market understandings, and suggestions on reliable financial debt investment alternatives. These groups frequently supply access to special offers and details on high-potential projects.

Think About REITs with Regional Emphasis

Some REITs and real estate funds concentrate specifically on financial obligation financial investments in Upstate New York. These vehicles enable investors to gain from financial obligation financial investments while getting geographic diversification and expert monitoring.

Work with Real Estate Investment Advisors

For customized advice, consider working with a monetary advisor or financial investment expert that concentrates on real estate. An advisor with regional know-how can aid identify high quality debt financial investment opportunities that line up with your danger tolerance and monetary objectives.

Final Thoughts on Financial Obligation Purchasing Upstate New York City Realty

Financial obligation investing in realty uses a special mix of safety and earnings generation, making it a excellent selection for those seeking to expand their financial investment portfolios. Upstate New York, with its steady demand, diverse home choices, and rejuvenated cities, offers an perfect backdrop for financial debt financial investments that can generate constant returns.

By focusing on due diligence, recognizing local market patterns, and choosing trustworthy borrowers, capitalists can make enlightened decisions that maximize their returns in this Debt investing real estate New York Upstate area's growing realty market. For investors seeking a reasonably low-risk method to participate in Upstate New York's development without directly managing residential or commercial properties, debt investing is an superb path forward.

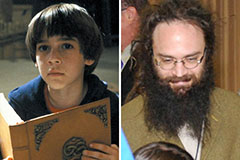

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!